This blog post ought to have been fairly straightforward to write, because the subject matter is clearly defined: how do we get the UK to climb the EV Euro League Table?

And it’s quite fitting too, since – at the time of writing – the Euro football tournament is underway and the UK’s EV market is definitely part of Team Europe, the continent leading the EV revolution right now (with the possible exception of China).

However, there were certain EV market nuances and complexities to take into consideration…

Coming up in this article:

1. Kick off – Phenomenal Market Growth

2. One for All with the Friendlies – Scandinavia leads the way

3. Passing the Ball Between the Players – Does renewable energy drive EV adoption?

4. Free Kicks & Penalties – The Impact of Incentives

5. Refereeing the Match – The EU and CO2 Emissions Targets

6. Star Players – Wealth and GDP in Relation to EV Adoption

7. Charging Down the Pitch – The Take-Up of EV Chargers

8. The End-of-Game Shootout – Summary of EV Adoption Factors

9. Final Score – Article Conclusion

Kick Off

In the UK, we have seen phenomenal growth in the new EV market over the past few years, from 0.5% of new Battery Electric Vehicles (BEVs) in 2018 to 7% in the past few months of 2021. Specifically, this means that although 38,000 were sold by the end of 2019, a full 108,000 were sold by the end of 2020 – during the first year of the pandemic – exceeding the predictions we previously made at the end of 2019.

Nevertheless, EV adoption in the UK is in the middle of the pack if we measure by percent adoption, or about 3rd if we measure by absolute sales numbers[1].

The question we’d like to explore in this article is why we aren’t further up the percentage table.

It’s evident that Scandinavian countries (especially Norway) lead impressively. Yet, intuitively, we might think adoption would struggle there, because, generally, an EV battery functions less well in cold climates.

One for All with the Friendlies

Looking at EV adoption in Norway and Sweden gives us a sort of glimpse into our future and understand that, actually, our adoption rates are going to approximate what’s happening in these countries. However, what we would like is to be more competitive rather than being stragglers, or even average. We want to lead, because ultimately, being higher in the league means a better economy for the UK.

It also means a cleaner, greener planet which in turn will slow changes in the climate and this will have positive, knock-on effects across the world and our societies.

All of these things are good, from a prestige, practical and long-term viewpoint. Which brings us back to this question: what is it about Scandinavian countries like Norway and other nations, that means they’re at the top right now?

And for the purposes of this article, we’ll mostly concentrate on Battery Electric Vehicles, rather than Plug-in Hybrid Electric Vehicles (PHEVs), because these are the only means of fully decarbonising transport by the 2050 timeframe – and we can see in Norway’s figures that the PHEV market is already being squeezed.

Passing The Ball Between The Players

At Versinetic, we engineers spent quite a bit of time considering a number of the obvious reasons why EV adoption might be favoured in one country or another.

For example, we might think that a primary driver is renewable or zero carbon energy. If we look at the leader: Norway, we find that Norway is about 98% renewable[2]. And Sweden has over 80% renewable or nuclear electricity[3] with wind power increasing rapidly. So clearly, it is a factor.

The problem is that when we look at other countries in Europe, the correlation starts to break down.

For example, France is 93% zero carbon (better than Sweden), but has an EV adoption rate similar to the UK[4].

Or consider the Netherlands, it is also near the middle of the EV adoption league, they’re #14, just below the UK, but astoundingly it’s near the bottom for zero carbon energy in the EU27[5].

Looking at Lithuania, it’s at the bottom for EV adoption, but is 7th in terms of zero carbon energy.

A line graph of EV adoption vs zero carbon energy is like a football team starting close to the opponent’s goal, losing possession and then spending all its time passing the ball in defence.

Free Kicks & Penalties

Another obvious possibility is that EV adoption is driven by government incentives. And it’s true that governments across the EU have provided incentives in various forms.

Sometimes, they do make a difference. For example, when the UK government cut incentives for PHEVs from £2.5K per car to zero, the market quickly shifted from being PHEV-dominated to being BEV-dominated. In that sense, it was a good thing because a large number of company PHEVs were being bought for the grant, but without domestic chargers being installed – resulting in PHEVs which emitted more CO2 than an equivalent combustion car. The archetypal fake-EVs as described by Transport & Environment[6].

The trouble here, though, is that most of the incentives across Europe, and particularly across the EU, are very similar. Purchase grants are generally around €4K to €6K; vehicle tax is waived and parking costs are sometimes cut or halved[7].

In addition, a number of states have introduced penalties for buying or driving combustion cars, a principle called Bonus Malus or “Polluter Pays”. The UK can be included here, due to additional vehicle tax for high-polluting cars and its carbon tax for fuels.

It’s likely though that at least in the UK, the need for such government incentives is reducing; as BEVs have become more cost competitive with combustion cars (and particularly plug-less hybrid cars); as well as PCP purchasing schemes whose monthly costs now overlap with comparable combustion cars; and an emphasis on Total Cost of Ownership.

This possibly explains why although the UK has continued to reduce its BEV incentives (now £2.5K/car up to cars costing £35K), it hasn’t fallen further behind in terms of plug-in market share and the market still appears to be growing exponentially.

This is encouraging, because although the EV market does need support against the incumbent combustion engine industry, if the EV market continued to be primarily dependent on government grants it would imply a lack of long-term viability, perhaps because people (or states) didn’t care about the environment or because the technological benefits weren’t sufficient.

Refereeing The Match

As an aside, it’s important to consider the referee of the EV industry. The EU is setting increasingly tough targets for vehicle CO2 emissions, and this has certainly driven higher plug-in adoption rates across Europe.

CO2 emissions targets are aimed at manufacturers rather than countries. However, from a manufacturer’s viewpoint, this is likely to mean a greater push from automakers to countries with the largest potential EV markets.

And basically that means Germany, France and the UK. We can already see that in the current figures.

Although the UK is about 13/30 for Plug-in EV adoption (just behind France and really lagging behind Germany in 6th place); it’s 10th in terms of combined CO2 emissions of new cars (2 places ahead of France, with Germany in 5th place); 7th in terms of BEVs (just ahead of France with Germany in 4th) we are Second in terms of absolute number of BEV sales, (with Germany in 1st place and France in 3rd).

This means that if manufacturers want to reduce their CO2 emissions as much as possible by picking the low-hanging fruit (and they do, because the EU is enforcing it), they will take their focus off Norway (because their market can only grow by 100%, i.e., 19K BEVs) and concentrate on the biggest markets – namely Germany, France and the UK.

In that sense, even though we are no longer members of the EU, we are still as central to EU emissions goals as we ever were. It means that the UK is likely to rise up all these other charts, thanks to the Referee – the EU itself.

Star Players

Or, we might think that the biggest influence on EV adoption is average GDP: the star players of Europe buying the most electric vehicles, because EVs have been expensive.

It’s true there is a general trend towards higher EV adoption and GDP. However, there are a number of outliers, such as Luxembourg and Ireland, with high GDP and low adoptions; or Bulgaria and Portugal which have a low GDP, but relatively high EV adoption.

As EVs reach price parity with other technologies, combustion (petrol or diesel) vehicles start to lose their economy of scale. Counter-intuitively, fuel prices will continue to go up even as demand falls against supply, because of the maintenance cost of existing supply lines and equipment will become increasingly dominant.

This makes EVs increasingly competitive and, consequently, GDP less of an issue. There is an entertaining Bloomberg video from 2016[8] about a related oil glut effect to that of 2014, notable for its prediction about 500,000 Tesla sales by the end of 2020 (Tesla hit just over 500,000) and at around 3:08 it asks us to imagine a future where “the rumbling streets of New York and New Delhi” suddenly fall silent.

Given the covid-19 pandemic and experiences of the past year, this is no longer hard to imagine.

Charging Down the Pitch

At some point, if a team wants to score, it usually has to charge down the pitch with the ball.

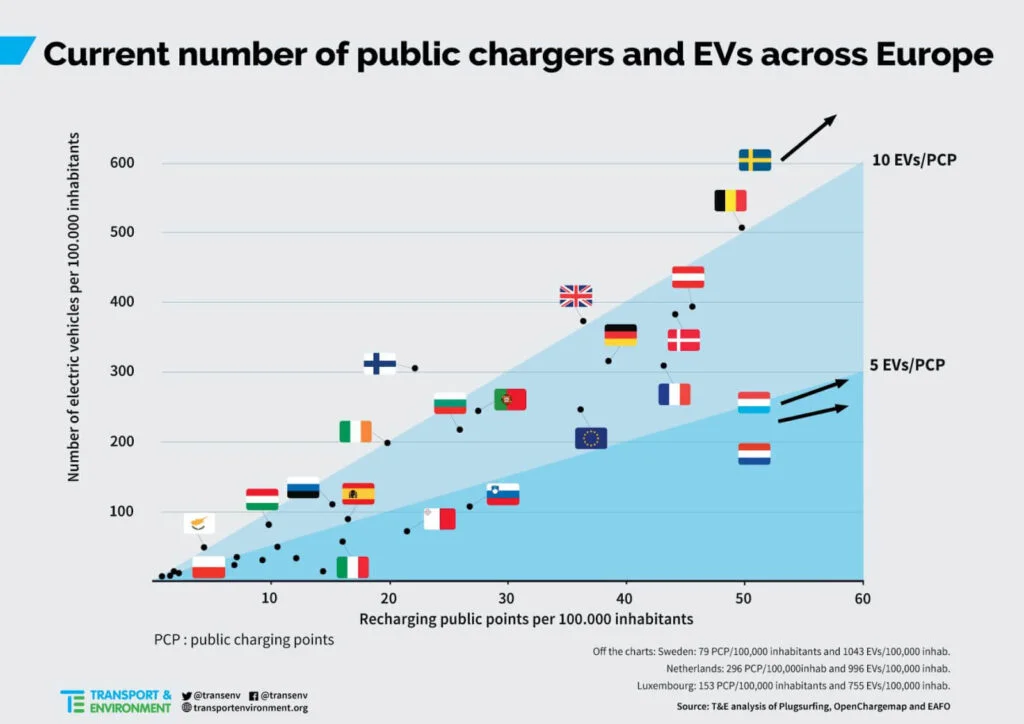

Surprisingly, it turns out that EV chargers themselves provide a really effective metric for electric vehicle adoption. This was discovered by one of our engineers by chance whilst reading a T&G paper[9] on European EV charging infrastructure.

Now, the T&G paper focuses on the EU directive on EVs per charging point, but from the viewpoint of this article, the number of charging points per capita is more interesting.

And that’s primarily because the population as a whole won’t be able to tell what the relationship between the number of EVs and charging points is (until they start to see large queues of EVs at charging points), but they can tell how many EV chargers there are in their environment.

The sheer familiarity of EV infrastructure normalises expectations of electric vehicles, driving the market. Let’s look at the T&G graph, reproduced here:

Image Credit: Transport and Environment

The UK is somewhere in the middle-right of the x-axis; pretty close to Germany and France, with the number of charging points generally tracking EV adoption.

What’s more interesting, though, is when we look at certain leading nations.

Provision of Charging Locations

Norway has 32.4 EVs per public charging point. It is way off the graph, but if it was represented, it would look dreadful. But it also has a phenomenal 294 charging points per 100K inhabitants.

Sweden has similar properties, it’s off the graph when it comes to both EVs per Public Charging point and also charging points per head of population.

And again, another outlier, Portugal, which is a relatively low-income EU country, but has a high number of charging points per 100,000 inhabitants, just below the UK.

The End-of-Game Shootout

Like any good match, EV adoption in Europe is full of dramatic surprises alongside some predictable moves and strategies.

To some degree, all of the influences we might expect, do, in fact, make a difference to how well an individual country can adopt EVs. Renewable and zero carbon energy does make a difference.

We can deduce that coal dominated countries like Poland would benefit from lower emissions strategies. At the same time, unlike Norway, we don’t have such an easily exploitable natural source of electricity and it will take quite a while for the UK’s renewable resources to reach their potential (because they’ll reflect the shift in how we use all our energy, rather than the rate of EV adoption).

Other tactics make a significant difference too, such as government support on offer, incentives and EU emissions directives. Lobbying these large-scale organisations about gaps in provision can and will keep up the pressure to transform transport. This is good – and essential – since they expect to be informed of industry and citizen aspirations.

It turns out, however, that throughout Europe, these measures are broadly similar for governments across the political spectrum, therefore it’s unlikely that the UK’s position will be hugely affected by these means.

Similarly, although a country’s wealth does have an effect on EV adoption, there’s not likely to be a huge shift in the short-term in our relative GDP – the Brexit effect notwithstanding – and the increasing competitiveness and sales models for EVs will, we anticipate, start to erode these advantages in the near term.

However, there is one thing that does stand out as a mechanism that communities, municipalities and businesses can exploit as a means of increasing EV adoption; the take-up of EV charging points.

Final Score

Fundamentally, the presence of charging points normalises the acceptance of EVs and displaces anxiety about range. In the long-term, it also leads to cheaper EVs in a wider range of market segments.

Let’s just hope that, going forwards, the UK performance in the Euro EV league table continues to improve…

…and doesn’t falter to mirror that of England’s bleak penalty shootout record.

How can Versinetic help you today?

From start-ups to blue chips, Versinetic’s embedded systems software developers are enabling companies to stay a step ahead by providing them with bespoke solutions. Maintain your competitive edge – contact us today and let your business be among them!

References

[1] https://cleantechnica.com/2020/08/22/germany-france-uk-lead-in-new-ev-sales-in-europe/

[2] https://www.regjeringen.no/en/topics/energy/renewable-energy/id2000124/

[3] https://sweden.se/climate/sustainability/energy-use-in-sweden

[4] https://en.wikipedia.org/wiki/Electricity_sector_in_France

[5] https://en.wikipedia.org/wiki/Renewable_energy_in_the_Netherlands

[7] https://elbil.no/english/norwegian-ev-policy/

[8] https://www.bloomberg.com/news/videos/2016-02-24/the-peak-oil-myth-and-the-rise-of-the-electric-car